Salesforce Revenue Cloud: The Future of Revenue Management

Improve sales cycles, billing, and compliance with one integrated solution.

Salesforce Revenue Cloud is an integrated solution designed to help businesses streamline their revenue operations. It encompasses the entire revenue lifecycle, including quote-to-cash, billing, and revenue recognition. The platform is built to manage complex revenue processes, aligning sales, finance, and operations teams on a unified platform. With its comprehensive features, Revenue Cloud accelerates growth, improves forecasting, ensures compliance, and delivers seamless customer experiences.

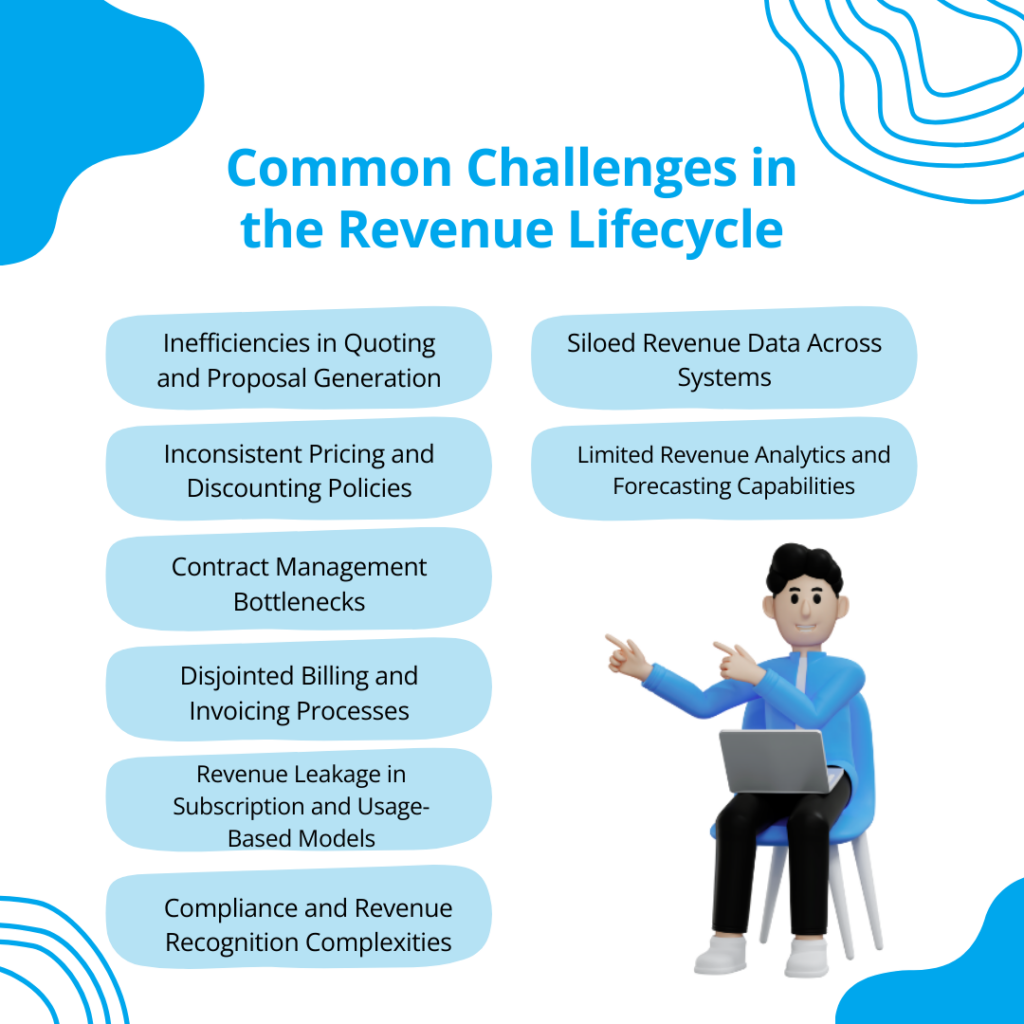

Common Challenges in the Revenue Lifecycle

Businesses striving for consistent revenue growth often encounter obstacles that hinder efficiency, profitability, and compliance. The revenue lifecycle—spanning from quoting and contract management to billing and revenue recognition—can become complex without the right technology and processes in place. Below are some of the most significant challenges organizations face in managing their revenue lifecycle effectively.

- Inefficiencies in Quoting and Proposal Generation: Manual and outdated quoting processes lead to inconsistencies in pricing, discounting, and approval workflows. Sales teams relying on spreadsheets or disconnected systems often struggle to generate accurate quotes, which can delay deal closures and erode customer confidence.

- Inconsistent Pricing and Discounting Policies: Without a unified pricing strategy, businesses risk revenue loss due to excessive or misaligned discounts. Sales teams may lack visibility into approved pricing structures, leading to margin erosion and missed opportunities for revenue optimization.

- Contract Management Bottlenecks: Poorly managed contract workflows create friction in negotiations, approvals, and renewals. Without automated contract lifecycle management, businesses risk losing revenue due to missed clauses, renewal lapses, and compliance oversights.

- Disjointed Billing and Invoicing Processes: A fragmented billing system can result in delayed invoices, billing inaccuracies, and customer disputes. Subscription-based businesses, in particular, face challenges in managing usage-based billing, renewals, and adjustments, which can lead to revenue leakage.

- Revenue Leakage in Subscription and Usage-Based Models: Recurring revenue businesses often struggle with subscription renewals, pricing changes, and revenue recognition. Without an automated system, businesses may fail to track revenue streams efficiently, leading to lost revenue opportunities.

- Compliance and Revenue Recognition Complexities: With evolving financial regulations such as ASC 606 and IFRS 15, businesses must ensure accurate revenue recognition. Non-compliance can lead to reporting errors, financial penalties, and reputational damage.

- Siloed Revenue Data Across Systems: Disconnected CRM, CPQ, billing, and ERP systems create data silos, making it difficult to gain a holistic view of revenue operations. Without real-time insights, businesses struggle with forecasting, decision-making, and aligning sales and finance teams.

- Limited Revenue Analytics and Forecasting Capabilities: A lack of real-time reporting and analytics tools can lead to inaccurate revenue forecasts and poor strategic planning. Without deep insights into revenue performance, businesses find it challenging to optimize pricing, sales strategies, and growth opportunities.

To address these challenges, organizations need an integrated revenue management solution. Salesforce Revenue Cloud streamlines quoting, billing, contract management, and revenue recognition, enabling businesses to optimize revenue processes, enhance customer experiences, and drive predictable growth.

Key Features of Salesforce Revenue Cloud

Salesforce Revenue Cloud is designed to streamline and optimize the entire revenue lifecycle, from quote to cash to revenue recognition. By integrating CPQ (Configure, Price, Quote), Billing, Subscription Management, and Revenue Recognition, Revenue Cloud helps businesses enhance efficiency, improve compliance, and drive predictable revenue growth. Below are the key features that make Salesforce Revenue Cloud a powerful solution for modern enterprises.

1. AI-Powered Configure, Price, Quote (CPQ) for Faster Sales Cycles

Salesforce Revenue Cloud includes an advanced CPQ solution that enables sales teams to configure complex products, apply accurate pricing, and generate error-free quotes. This automation reduces manual effort, accelerates deal closures, and ensures pricing consistency across all channels.

- Guided Selling: Recommends the best products and bundles based on customer needs.

- Dynamic Pricing Rules: Ensures discounts, promotions, and approvals follow pre-set policies.

- Automated Quote Generation: Eliminates manual errors, improving accuracy and efficiency.

2. Automated Billing for Recurring and Usage-Based Revenue

Managing billing for one-time, subscription-based, and usage-based models can be challenging. Salesforce Billing automates invoicing, payment collection, and revenue recognition while providing real-time insights into billing performance.

- Flexible Billing Models: Supports one-time, milestone, subscription, and usage-based billing.

- Seamless Integration with CPQ: Ensures accurate invoicing based on approved quotes and contracts.

- Automated Payment Processing: Reduces billing disputes and improves cash flow management.

3. Revenue Recognition and Compliance

Ensuring accurate revenue recognition is essential for financial compliance. Salesforce Revenue Cloud simplifies complex revenue recognition processes, ensuring businesses meet regulatory standards like ASC 606 and IFRS 15.

- Automated Revenue Recognition: Aligns revenue recognition with contract terms and performance obligations.

- Audit-Ready Financial Records: Provides accurate revenue reporting for compliance and forecasting.

- Real-Time Revenue Insights: Helps finance teams track revenue performance across different streams.

4. Subscription and Renewal Management

With the rise of subscription-based business models, Revenue Cloud offers tools to manage recurring revenue, contract renewals, and upsell opportunities.

- Automated Renewal Workflows: Reduces churn by sending proactive renewal reminders.

- Usage-Based Pricing: Dynamically adjusts billing based on customer usage.

- Upsell & Cross-Sell Automation: Identifies expansion opportunities based on customer data.

5. Revenue Operations and Analytics for Data-Driven Decisions

Revenue Cloud provides real-time revenue analytics and dashboards that help sales, finance, and operations teams make data-driven decisions.

- Predictive Revenue Forecasting: Leverages AI and historical data to project future revenue.

- Comprehensive Sales & Finance Alignment: Ensures collaboration across revenue-generating teams.

- Centralized Revenue Dashboard: Offers full visibility into revenue performance and pipeline health.

6. Seamless Integration with Salesforce Ecosystem & Third-Party Apps

As part of the Salesforce platform, Revenue Cloud natively integrates with Sales Cloud, Service Cloud, and ERP systems, ensuring seamless data flow between sales, finance, and customer support.

- ERP Integration: Connects with NetSuite, SAP, Oracle, and other ERP solutions for unified financial management.

- CRM and CPQ Connectivity: Ensures sales teams have accurate pricing and customer data at all times.

- API & Customization Capabilities: Allows businesses to tailor the solution to their specific needs.

Salesforce Revenue Cloud Products

1. Salesforce CPQ (Configure, Price, Quote): Enables sales teams to configure products, apply accurate pricing, and generate error-free quotes.

2. Salesforce CPQ+: Includes all CPQ features plus advanced functionalities like document generation, advanced approvals, and usage-based pricing.

3. Salesforce Billing: Extends CPQ capabilities to automate invoicing, payment collection, and revenue recognition.

4. Subscription Management: Designed for businesses with recurring revenue models, enabling automated renewals, subscription pricing, and usage-based billing.

5. Revenue Cloud: A comprehensive solution that unifies product catalog management, transaction management, CPQ, and contract lifecycle management.

6. Salesforce Contracts: Manages the end-to-end contract process, including authoring, redlining, and obligation management.

Benefits of Salesforce Revenue Cloud

Salesforce Revenue Cloud helps businesses streamline revenue operations, optimize pricing, and ensure accurate billing and revenue recognition. Below are the key benefits:

1. Faster Sales Cycles

- Automates product configuration, pricing, and quote approvals.

- Reduces manual errors in proposals and contracts.

- AI-powered recommendations help sales teams close deals faster.

2. Improved Pricing and Discount Management

- Ensures consistent pricing across all sales channels.

- Implements approval-based discounting to prevent revenue leakage.

- Enables automated contract renewals and upselling opportunities.

3. Automated and Accurate Billing

- Eliminates errors in invoices and payments.

- Supports one-time, subscription-based, and usage-based billing models.

- Improves cash flow with automated invoicing and faster revenue collection.

4. Compliance with Revenue Recognition Standards

- Automates revenue recognition to comply with ASC 606 and IFRS 15.

- Provides audit-ready financial reporting to minimize compliance risks.

- Integrates seamlessly with ERP systems like NetSuite, SAP, and Oracle.

5. Enhanced Subscription and Recurring Revenue Management

- Automates renewals to reduce customer churn.

- Allows customers to modify subscriptions through self-service portals.

- Supports dynamic, usage-based pricing for flexible revenue models.

6. Real-Time Revenue Insights and Forecasting

- AI-driven analytics predict future revenue trends.

- Unified dashboards provide real-time visibility into revenue performance.

- Helps businesses make data-driven decisions for pricing and growth.

7. Seamless Integration with Salesforce and ERP Systems

- Connects Sales Cloud, Service Cloud, and CPQ for a unified sales and finance view.

- Works with NetSuite, SAP, Oracle, and third-party ERP systems.

- Offers API and customization options for business-specific workflows.

Why Choose Salesforce Revenue Cloud?

Salesforce Revenue Cloud is a comprehensive solution that empowers businesses to optimize their revenue lifecycle. From quote-to-cash automation to revenue recognition and forecasting, it streamlines processes for efficiency and accuracy. Here’s why businesses should choose Salesforce Revenue Cloud:

Faster Deal Closure

- Automate quoting, pricing, and approvals to accelerate sales cycles.

- Reduce manual errors with AI-driven deal structuring.

- Configure complex products and pricing with ease.

Stronger Compliance & Audit Readiness

- Ensure adherence to ASC 606 & IFRS 15 revenue recognition standards.

- Maintain transparency with automated audit trails.

- Reduce financial discrepancies with real-time revenue tracking.

Enhanced Customer Experience

- Provide seamless subscription management and renewals.

- Offer personalized pricing and discounts to customers.

- Improve self-service options with automated billing and payment processing.

Higher Revenue Predictability

- Gain real-time financial insights to forecast revenue accurately.

- Minimize revenue leakage with automated contract management.

- Optimize recurring revenue models for long-term profitability.

Efficient Revenue Operations

- Unify sales, finance, and customer service on a single platform.

- Automate invoicing, payments, and revenue recognition workflows.

- Improve collaboration with AI-powered analytics and insights

Scalable Growth & Expansion

- Quickly adapt to pricing changes, market shifts, and business growth.

- Support subscriptions, usage-based pricing, and one-time transactions.

- Integrate seamlessly with Salesforce clouds for a unified customer experience.

By adopting Salesforce Revenue Cloud, businesses can reduce revenue leakage, improve operational efficiency, and scale effortlessly. Whether you’re a SaaS company, a manufacturing business, or a financial service provider, Revenue Cloud ensures you stay ahead with intelligent revenue management

Salesforce Revenue Cloud for Your Industry

Salesforce Revenue Cloud is designed to support diverse industries by streamlining revenue operations, automating billing, and ensuring compliance with financial regulations. Below are some of the use cases for different industries:

1. Technology & SaaS

- Automates subscription billing for SaaS companies with usage-based or recurring revenue models.

- Manages contract renewals and pricing adjustments dynamically.

- Optimizes quote-to-cash with CPQ and automated approvals.

2. Manufacturing & Industrial Products

- Configures complex product pricing with Salesforce CPQ.

- Automates contract-based pricing and discounts for bulk orders.

- Manages billing across multiple distribution channels.

3. Healthcare & Life Sciences

- Manages compliance-driven pricing for medical devices and pharmaceutical products.

- Automates contract and rebate management for hospitals and distributors.

- Supports subscription-based pricing for healthcare SaaS platforms.

4. Financial Services & Insurance

- Automates policy pricing and billing for insurance providers.

- Manages commissions and partner revenue for financial advisors.

- Ensures compliance with revenue recognition standards.

5. Retail & E-Commerce

- Optimizes pricing and discounting for seasonal promotions.

- Automates recurring billing for subscription-based e-commerce services.

- Seamlessly integrates with CRM and order management systems.

6. Telecommunications

- Automates contract-based pricing for enterprise customers.

- Manages subscription-based billing for data plans and digital services.

- Reduces revenue leakage through accurate usage tracking.

7. Professional Services & Consulting

- Automates project-based billing with milestone tracking.

- Manages complex contract terms and service pricing.

- Integrates revenue recognition with project milestones.

8. Education & EdTech

- Manages subscription-based pricing for online courses and memberships.

- Automates tuition billing and fee collection for educational institutions.

- Supports dynamic pricing for course bundles and special offers.

9. Energy & Utilities

- Automates billing for usage-based energy consumption models.

- Configures complex pricing structures for commercial and residential customers.

- Ensures compliance with regulatory standards for pricing and billing.

Implementing Salesforce Revenue Cloud

A structured implementation minimizes revenue leakage, ensures compliance with financial regulations, enhances customer experience through seamless quoting and billing, and improves revenue predictability with real-time analytics.

- Define Business Goals and Revenue Processes: Start by identifying key revenue challenges such as pricing inconsistencies, billing inefficiencies, and compliance risks. Align Salesforce Revenue Cloud features with business objectives and set key performance indicators (KPIs) to measure success.

- Assess Existing Systems and Data Readiness: Evaluate current CRM, ERP, and billing systems to ensure compatibility with Revenue Cloud. Data readiness is crucial, so standardizing and cleaning revenue-related data before migration will help prevent discrepancies. Integration across sales, finance, and customer support workflows is essential for smooth operations.

- Configure Salesforce CPQ and Billing: Set up product catalogs, pricing rules, and discount approvals within CPQ. Billing automation should be configured to handle one-time, recurring, and usage-based models. Revenue recognition policies must be aligned with financial compliance standards like ASC 606 and IFRS 15.

- Automate Workflows and Approvals: Implement automated approval processes for quotes, contract renewals, and invoicing to reduce delays and human errors. Integration with finance and legal teams ensures compliance while optimizing collaboration between sales and customer service improves efficiency.

- Train Teams and Encourage Adoption: Providing training sessions for sales, finance, and customer support teams is essential for successful adoption. Hands-on workshops, user guides, and ongoing support help employees maximize the platform’s potential. Encouraging adoption through incentives and tracking usage further strengthens engagement.

- Test, Deploy, and Optimize: Thorough testing is necessary to ensure accuracy in pricing, quoting, and billing before deployment. Rolling out Salesforce Revenue Cloud in phases minimizes risks and allows for gradual adjustments. Continuous monitoring, feedback collection, and workflow optimization help improve efficiency over time.

- Monitor Performance and Scale for Growth: Tracking revenue analytics and financial metrics helps measure the impact of the implementation. Identifying automation opportunities and optimizing processes ensures scalability as the business grows. Revenue Cloud should be continuously refined to adapt to evolving revenue models and market demands.

A well-executed Salesforce Revenue Cloud deployment leads to optimized revenue operations, increased profitability, and long-term business success.

FAQs on Salesforce Revenue Cloud

1. What is Salesforce Revenue Cloud?

Salesforce Revenue Cloud is a revenue management solution that integrates CPQ, Billing, Subscription Management, and Revenue Recognition to streamline pricing, quoting, invoicing, and compliance. It helps businesses automate the quote-to-cash process, reduce revenue leakage, and ensure accurate financial reporting.

2. How does Salesforce Revenue Cloud help with subscription-based revenue models?

Revenue Cloud automates subscription billing, renewals, and usage-based pricing, ensuring accurate invoices and timely payments. It also provides self-service portals for customers to manage their subscriptions, reducing churn and improving customer retention.

3. What industries benefit from Salesforce Revenue Cloud?

Revenue Cloud is widely used in industries such as Technology & SaaS, Manufacturing, Healthcare, Financial Services, Retail, Telecommunications, and Professional Services. It supports businesses with complex pricing models, recurring revenue, and contract-based billing.

4. How does Salesforce CPQ work within Revenue Cloud?

Salesforce CPQ (Configure, Price, Quote) automates product configuration, pricing rules, and discount approvals to generate accurate quotes quickly. It ensures sales teams apply the right pricing strategies while reducing errors and approval delays.

5. Can Salesforce Revenue Cloud integrate with ERP systems?

Yes, Revenue Cloud integrates seamlessly with ERP platforms like NetSuite, SAP, Oracle, and Microsoft Dynamics, ensuring consistent revenue tracking and financial reporting across sales, finance, and operations.

6. How does Salesforce Revenue Cloud support revenue recognition compliance?

Revenue Cloud automates revenue recognition in compliance with ASC 606 and IFRS 15 standards. It ensures accurate financial reporting by aligning revenue recognition with contract terms and performance obligations.

7. What billing models does Salesforce Revenue Cloud support?

It supports various billing models, including one-time, milestone-based, subscription-based, and usage-based billing. Businesses can customize invoices and automate payment collections based on customer agreements..

8. How does Revenue Cloud improve sales efficiency?

By automating quoting, contract approvals, and billing, Revenue Cloud shortens the sales cycle. Sales teams can generate accurate quotes faster, apply AI-driven pricing recommendations, and close deals more efficiently.

9. Is Salesforce Revenue Cloud customizable for unique business needs?

Yes, Revenue Cloud offers configurable workflows, pricing rules, and APIs that allow businesses to tailor it to their revenue processes. Custom integrations and automation enhance its flexibility for specific industry needs.

10. How can businesses measure the success of Revenue Cloud implementation?

Businesses can track key metrics such as deal closure time, billing accuracy, revenue leakage reduction, subscription renewal rates, and compliance adherence. AI-powered analytics provide insights into revenue performance and growth opportunities.

Start Your Revenue Cloud Project

Optimizing your revenue processes with Salesforce Revenue Cloud ensures seamless quoting, billing, and revenue recognition while reducing inefficiencies. With automated workflows, AI-driven insights, and seamless integrations, businesses can improve revenue predictability and compliance. Whether you’re scaling subscriptions, streamlining pricing, or enhancing billing accuracy, Revenue Cloud helps you stay ahead.

Ready to transform your revenue operations? Contact us today for a free no obligation discovery session to explore how Salesforce Revenue Cloud can drive efficiency and growth for your business.